Searching for a suitable financial institution for a loan, insurance, or savings is usually time-consuming and confusing. If all the information is available on the same platform, that would be much convenient, isn’t it?

Rumsan Group has recently designed such a platform called ‘Rumsan Money’. Besides this, they are also working to simplify the banking experience of customers through blockchain technology.

What is Rumsan Money?

Rumsan Money is a fintech product that is designed to provide collective information regarding insurance policies, the interest rate in loans and deposits on a single platform. At present, they have integrated information from 27 commercial banks and 20 insurance companies.

“Today as the financial sector is progressing towards digital, this is to help our users get all the information in the same place,” says Bibek Khadka, project lead of Rumsan Money.

Rumsan Money is a product of Rumsan Group of Companies. The parent company has developed various digital products related to finance, health, education, social media and agriculture.

The team of this newly launched fintech product consists of five members. Santosh Shrestha, CEO and Co-founder of Rumsan Group and advisor of Rumsan Money, Ruchin Singh, advisor, Rumsan Money, Bibek Khadka, project lead of Rumsan Money, Raktim Shrestha, CTO and Raman KC, COO of Rumsan Group company are the members of the team.

How Rumsan Money works?

One can click Rumsanmoney.com and get all the necessary information about banks and insurance.

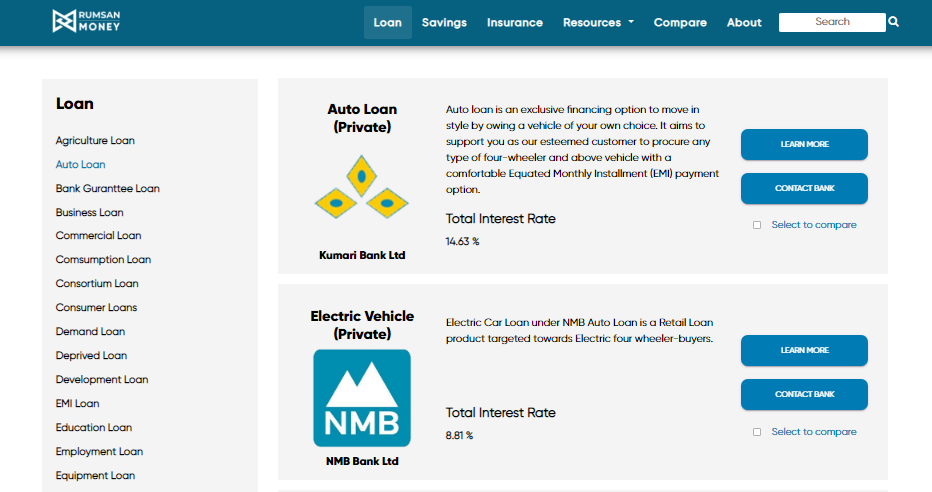

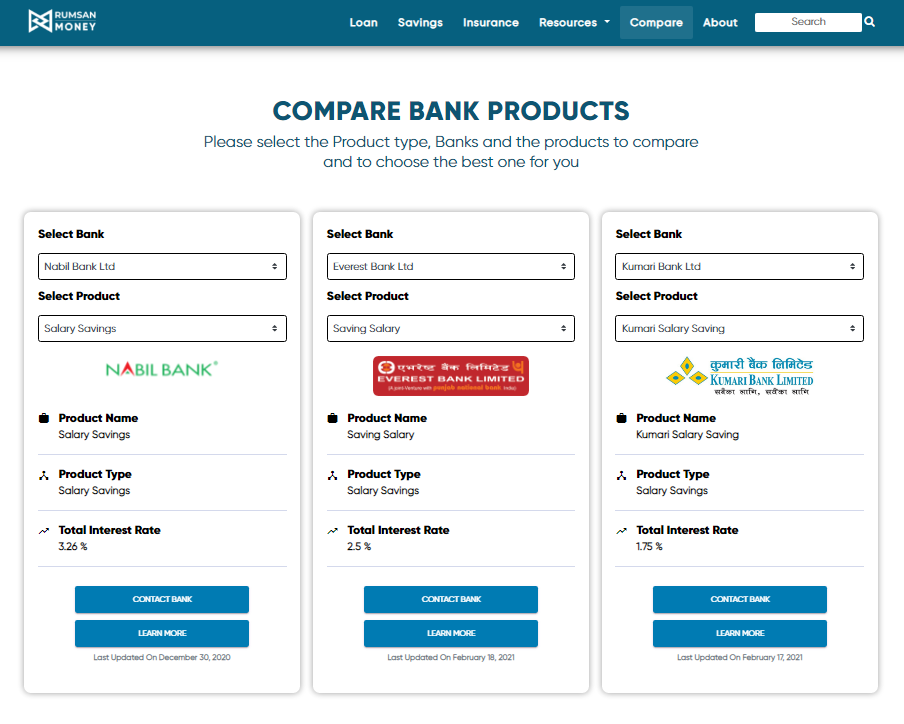

The platform has four options Loan, Savings, Insurance, Resources and Compare. We get information about interest rates and details of all the banks and insurance in Nepal on clicking the first three options.

If you click the option ‘Resources’, you can get information on all the products of every bank and insurance company. The information includes their various loan and savings products with detail of their terms and conditions.

Apart from this, the platform also provides knowledgeable content about the different types of loans and savings. For example: If we want to know about SME loans, we get detailed information about SME loans, their nature and their suitability. This means the users won’t have to spend time browsing other websites to know about SME loans.

“There are many of us who don’t have a proper idea about how loans or any financial services work. So, we have added this feature to educate our users in terms of financial products,” says Khadka. He views that this feature will help customers to make an informed decision.

Another feature is ‘Compare’ where one can easily compare the loans, savings and interests of different financial institutions.

ALSO READ: Learnhub.online: This New EdTech Startup is Helping Kids Code from the Comfort of Home

Ideation

Rumsan Group has been supporting various humanitarian causes and developing various digital products using blockchain technology since its establishment in 2013.

According to Ruchin Singh, recently the team approached various banks and financial institutions to develop decentralized Know Your Customers (KYC) system. KYC processes are quite a tedious process for both organizations and customers. It involves a huge amount of paperwork and procedures take a long time.

The team, therefore, started pitching an idea about decentralized KYC with various BFIs around a year ago. KYC verification through blockchain technology will allow the collection of data from multiple platform providers into one platform which is cryptographically secured.

However, as Nepali banks are already adopting various kinds of technology for digitization, initiating blockchain technology for KYC seemed to take time as it is comparatively new for the market.

Hence, the team themselves began working for this KYC system. According to Khadka, the team is designing a feature from where the users can update their KYC. This means the users will not have to update their KYC repeatedly. If one bank approves it, the customers can submit the same KYC to the other banks.

Also, as there was no space where one could compare the financial services of banks and insurance based on their price, interest rate and benefits, the team decided to embark on the current concept.

“This is our first phase where are focused on giving information to the users. In the second phase, we will work on connecting the customers with the bank. We will create a system where users can process the loan or get an insurance policy from the same platform,” says Singh.

Followed by that, we will create a system of blockchain-based digital KYC, he adds.

Moving Forward

As the platform has been launched recently, there is more to work on its revenue model. “This is just an informative platform for now. Gradually, we will earn revenue by generating a lead for banks and insurance companies,” says Singh.

The startup aims to educate the users about the know-how and procedures of banks and insurance. Meanwhile, their focus is also to connect them to suitable institutions using more efficient technology for loan, insurance and deposit processes.

READ NEXT: Danphe Care: This Telehealth Platform is Providing Remote Consulting to Covid-19 Patients

-

Seres 3 Electric Car Incident in Kathmandu: Initial Reports Point to Wiring IssueHIGHLIGHTS A probable fire incident occurred in a Seres 3 EV in Sitapaila, Kathmandu. Preliminary…

-

Samsung Galaxy S24 FE with Exynos 2400e and Galaxy AI Launched in NepalHIGHLIGHTS The Samsung Galaxy S24 FE price in Nepal is Rs. 94,999 (8/256GB). It is…

-

vivo V40 Lite 4G with Snapdragon 685 and 50MP Camera Launched in NepalHIGHLIGHTS The Vivo V40 Lite 4G price in Nepal is Rs. 36,999 (8/256GB). The phone…