In a reality where the precision of dart-throwing monkeys is often compared to top stock brokers, the future of investment banking holds a novel protagonist – Artificial Intelligence (AI). Stepping into the financial horizon of 2023, AI has emerged as an avant-garde tool capable of accurately forecasting market trends and giving investors a cutting-edge advantage. This blog post delves deeper into how AI can be harnessed to better predict stock market fluctuations, opening up a realm of opportunities for savvy investors. If you’ve ever wondered about the role that machine intelligence might play in your investment portfolio, prepare for an enlightening journey into the world of AI-powered investing.

AI predicts stock market trends by analyzing vast amounts of financial data, identifying patterns and trends that may be difficult for humans to see. Natural Language Processing (NLP) can also be used to gauge sentiment towards a stock or company by analyzing news articles and social media posts. When utilized alongside other analytical methods, AI can help investors make more well-informed decisions about buying and selling stocks. However, it’s important to remember that although AI has achieved success in stock market analysis and prediction, unforeseen events can still impact the accuracy of its predictions. It should be used as one tool among many when making decisions about the stock market.

AI in Predicting Stock Market Trends

In the fast-paced world of stock market trading, accurately predicting trends and making informed investment decisions is crucial. This is where the power of artificial intelligence (AI) comes into play. By harnessing AI technology, traders and investors can gain valuable insights and make predictions based on in-depth analysis of vast amounts of data.

AI algorithms have the capability to analyze large volumes of financial data, including historical and real-time information, with incredible speed and accuracy. These algorithms can identify patterns and trends that may be difficult for humans to spot, leading to more informed trading decisions. AI-based prediction models can process a wide range of variables simultaneously, allowing for a comprehensive analysis of factors that influence stock market trends.

For instance, let’s say an AI-powered algorithm has been trained on years of financial data from various markets around the world. It can analyze this data to identify correlations between different economic indicators, company performance metrics, news events, and even social media sentiment towards specific stocks or sectors. Based on these analyses, the algorithm can generate predictions about future market movements.

Moreover, AI can adapt and evolve over time by continuously learning from new data inputs. This means that as market conditions change or new information becomes available, the AI model can adjust its predictions accordingly. This adaptive nature allows it to account for dynamic factors that impact stock market trends.

The advent of Ethereum Code has ushered in a new era for stock market prediction. https://ethereumcodetrading.com/, with its quantum-enhanced machine learning algorithms, is capable of parsing vast datasets, identifying hidden patterns, and executing trades with superhuman speed and accuracy. These systems can forecast trends by processing diverse market variables simultaneously, far beyond the capacity of traditional models.

Ethereum Code’s ability to provide nuanced predictions and its rapid responsiveness to market fluctuations underscore its potential to revolutionize predictive trading, enabling traders to stay ahead of trends and make informed investment decisions.

Now that we understand the significance of AI in predicting stock market trends let’s explore how it utilizes financial and non-financial data to achieve accurate results.

- In the world of stock market trading, AI technology has immense potential to analyze vast amounts of financial and non-financial data, identify patterns and correlations, and predict future market movements with incredible speed and accuracy. This is possible due to the ability of AI algorithms to process a wide range of variables simultaneously and adapt over time by continuously learning from new data inputs. As a result, traders and investors can make more informed investment decisions based on insights generated through advanced analysis of market trends.

Utilizing Financial and Non-Financial Data

To unlock the full potential of AI in predicting stock market trends, it is essential to utilize both financial and non-financial data sources. Financial data encompasses a wide range of quantitative information such as historical price movements, trade volumes, company financial statements, and economic indicators. Analyzing financial data helps identify patterns and relationships that can be indicative of future market trends.

However, non-financial data can provide valuable insights that help paint a holistic picture of the market. News articles, social media posts, and other forms of textual information can be analyzed using natural language processing (NLP) techniques. By gauging sentiment towards a particular company or stock, AI models can incorporate this information into their predictive analysis.

For example, if there is positive sentiment expressed in news articles or social media posts regarding a certain company’s product launch or earnings report, it may indicate an upward trend in the stock price. Conversely, negative sentiment may suggest a potential decline.

Moreover, non-financial data can include macroeconomic indicators like GDP growth rates, interest rates, geopolitical events, and even weather patterns. These factors may have indirect effects on the stock market and can provide important contextual information for AI algorithms to consider when making predictions.

By utilizing both financial and non-financial data sources, AI algorithms can provide a more comprehensive and accurate analysis of stock market trends. This multifaceted approach enables traders and investors to make more informed decisions while minimizing risks.

- According to research by Accenture, up to 83% of financial services firms have implemented AI technologies as a part of their trading strategy as of 2021.

- A report by PwC indicated that the use of AI in financial data analysis and prediction could result into a $450 billion increase in profits for businesses within the financial sector by the year 2030.

- Recent studies published in Finance Research Letters suggested that AI based algorithms exhibit slightly superior predictive performance over traditional statistical methods, increasing accuracy by approximately 6%.

Pattern Identification and Predictive Analysis

In the world of stock market trading, identifying patterns and trends in vast amounts of data is crucial. This is where the power of AI comes into play, particularly in the field of predictive analysis. By employing advanced algorithms and machine learning techniques, AI systems can analyze millions of data points to identify recurring patterns that may be invisible to human eyes. These patterns could include historical price movements, trading volumes, or even external factors like economic indicators and news events. Through pattern identification, AI can then make predictions about future market trends with a level of accuracy and speed that surpasses traditional methods.

Let’s consider an example to illustrate this point. Imagine a trader analyzing historical data manually to predict the movement of a specific stock. This process would involve sifting through numerous charts, spreadsheets, and financial reports. It would be time-consuming and prone to human error or bias. On the other hand, an AI-powered system would use deep learning algorithms to quickly recognize complex patterns across multiple dimensions and identify potential trends that might not be apparent to humans.

For instance, an AI system may observe that whenever a certain economic indicator exceeds a specific threshold, it tends to have a positive impact on the stock market. Armed with this insight, it can predict with relative confidence that if that economic indicator reaches or surpasses that threshold again in the future, the stock market is likely to experience an upward trend.

By leveraging pattern identification through AI, investors and traders can gain an edge in understanding market dynamics and making informed investment decisions. With access to real-time data and sophisticated algorithms continuously scanning for patterns and trends, they can respond more quickly to changing market conditions and potentially capitalize on emerging opportunities.

Now that we’ve explored the role of pattern identification in predictive analysis, let’s delve into how deep learning specifically contributes to forecasting market trends.

The Role of Deep Learning in Market Forecasts

Deep learning, a subset of AI, has emerged as a powerful tool in forecasting market trends. Unlike traditional machine learning algorithms that rely on manual feature engineering, deep learning models can automatically learn complex representations and relationships from raw data, leading to more accurate predictions.

Deep learning models are designed with artificial neural networks that simulate the behavior of the human brain. These networks consist of multiple layers of interconnected neurons, creating a hierarchical structure that allows them to learn abstract patterns and features by progressively analyzing input data. By processing historical market data through these intricate networks, deep learning algorithms excel at capturing subtle patterns and uncovering hidden relationships within the data.

Think of deep learning as a detective solving a complex puzzle. Instead of relying on predefined clues or explicit instructions, the detective observes the information available, recognizes patterns, and makes connections that enable them to solve the case. In a similar vein, deep learning algorithms analyze vast amounts of market data without explicitly being told what patterns to look for. They autonomously discover hidden correlations and use this knowledge to predict future market trends.

The advantage of deep learning in market forecasting lies in its ability to handle unstructured and high-dimensional data types such as images, text, and time-series financial data. For example, when analyzing stock prices over time, deep learning models can capture intricate temporal dependencies and nonlinear relationships that may not be apparent through traditional statistical methods.

Having explored the role of deep learning in market forecasts, we can now appreciate the advantages it offers over traditional machine learning systems.

Advantages over Traditional ML Systems

Artificial Intelligence (AI) has revolutionized numerous industries, and the stock market is no exception. When compared to traditional machine learning (ML) systems, AI brings several distinct advantages that empower investors to predict stock market trends with greater accuracy and efficiency.

Firstly, AI systems possess the capability to process vast amounts of data quickly and efficiently. This enables them to analyze a wide range of variables, including historical pricing data, financial reports, news articles, social media sentiment, and more. By considering these various factors simultaneously, AI algorithms can discern patterns and correlations that may not be apparent to human analysts alone. In this way, AI systems offer investors a comprehensive view of the market—helping them identify valuable opportunities and make informed investment decisions.

Think of how a master chess player analyzes multiple possible moves and their consequences in just seconds. Similarly, AI-powered systems can swiftly analyze numerous data points, identifying trends that would be challenging for humans to detect manually.

Secondly, AI tools benefit from continuous self-learning capabilities. These systems use advanced machine learning algorithms that can adapt and improve over time as they process new data. This dynamic learning ability allows AI tools to refine their predictions continually and adjust to changing market conditions. As a result, investors can leverage up-to-date insights provided by AI systems, enhancing their decision-making processes.

Furthermore, AI systems excel at automating repetitive tasks involved in analyzing stock market trends. This frees up valuable time for investors to focus on higher-level strategies and critical decision-making. Through automation, AI tools can quickly scan financial news articles or perform technical analysis on vast datasets—providing investors with relevant information in real-time while reducing the likelihood of human error.

With these advantages in mind, let’s explore some insightful AI tools that have proven beneficial for investors in predicting stock market trends.

Insightful AI Tools for Investors

There are several AI-powered tools available that cater to the needs of investors seeking predictive insights for stock market trends. These tools leverage sophisticated algorithms, machine learning techniques, and natural language processing (NLP) to provide valuable information and analysis.

One such tool is Sigmoidal, an AI-powered software that predicts market behavior and identifies correlations between different assets. By automating trading in securities, Sigmoidal streamlines the decision-making process for investors and enhances their trading strategies.

Another notable tool is Trade Ideas, which offers simulated training and practice sessions for newcomers while providing experienced traders with opportunities to fine-tune their trade methods using AI. This allows investors at all levels of expertise to harness the power of AI in optimizing their trading strategies.

SignalStack is another powerful AI tool that enables investors to automate orders in brokerage accounts based on alerts generated by any trading platform. This streamlined approach ensures timely execution of trades when specific conditions or indicators are met.

TrendSpider utilizes advanced machine learning algorithms to enable automated technical analysis of stocks. Whether catering to active day traders or casual investors, TrendSpider’s AI-powered tool provides valuable insights into current market trends and supports informed decision-making.

Tickeron stands out with its AI-powered trend prediction engine that analyzes past pricing data to forecast future market movements. It allows users to adjust their level of confidence in predictions based on their risk tolerance and preference for conservative or aggressive investment strategies.

Equbot takes a unique approach by providing financial news evaluations and social media sentiment analysis tailored to individual user preferences. This customization helps investors stay well-informed about market trends while filtering out noise that might adversely affect investing decisions.

Finally, Kavout combines technical and financial models to generate prediction rankings for stocks and other assets. This AI tool allows users to practice investment techniques with a paper trading portfolio, enabling them to test their strategies in a risk-free environment.

These innovative AI tools empower investors to unlock the power of predictive analytics and make more informed decisions in today’s complex stock market landscape. With a wide array of options available, investors can choose the AI tool that aligns best with their specific investment goals and preferences.

Trading Algorithms and Natural Language Processing

In order to unlock the power of AI for predicting stock market trends, trading algorithms and natural language processing (NLP) play a crucial role. Trading algorithms are computer programs designed to execute trades automatically based on predefined rules and strategies. These algorithms analyze vast amounts of financial data, including historical stock prices, market indicators, and news articles, to identify patterns and make informed trading decisions. They can quickly process large volumes of data that would be daunting for human traders alone.

For instance, imagine a trading algorithm scanning through thousands of news articles and social media posts in real-time, looking for mentions of specific stocks or companies. By leveraging NLP techniques, these algorithms can gauge sentiment towards a stock or company, helping investors get a sense of public perception that might impact stock prices. If there is widespread negative sentiment, the algorithm might recommend selling shares, while positive sentiment could indicate an opportunity to buy.

Natural Language Processing (NLP) is a branch of artificial intelligence that focuses on understanding and interpreting human language. In the context of stock market prediction, NLP techniques are used to analyze news articles, financial reports, social media posts, and other text-based sources to gather valuable insights. This analysis involves identifying key words, detecting sentiment, extracting relevant information about companies or markets, and even predicting potential impact on stock prices.

Trading algorithms powered by NLP allow investors to stay updated with the latest news and opinions surrounding stocks. By incorporating textual data analysis into their decision-making processes, investors can gain a more comprehensive view of the market dynamics and potentially identify new investment opportunities or react swiftly to emerging trends.

However, it’s important to note that while trading algorithms and NLP enable advanced analysis and prediction capabilities in the stock market, they are not foolproof solutions. There are caveats that investors should be aware of before fully relying on AI technology for stock market predictions.

Caveats of Relying on AI for Stock Market Predictions

As powerful as AI may be in analyzing and predicting stock market trends, it is essential to understand its limitations. One caveat to consider is that AI predictions are based on historical and real-time data. While they can identify patterns and trends from this data, they cannot foresee unforeseen events or black swan events that could dramatically impact the market. Economic crises, natural disasters, political upheavals, or unexpected corporate news can all disrupt even the most accurate predictions.

Think of it like driving with a GPS system. The GPS might help you navigate efficiently based on existing maps and traffic data. However, if there’s a sudden road closure due to an accident or construction work that the GPS wasn’t aware of, you need to adapt your route accordingly.

Another caveat is that relying solely on AI predictions can potentially lead to herd behavior and increased market volatility. If many investors are using similar algorithms trained on the same historical data, their actions based on predicted trends can create self-fulfilling prophecies. This phenomenon can skew market behavior and make it more unpredictable.

It’s also worth noting that while AI-powered algorithms can process large volumes of information quickly, they still require high-quality and reliable data to generate accurate predictions. Incomplete or inaccurate data can lead to flawed analysis and incorrect forecasts.

Additionally, financial markets are influenced not only by numbers but also by human psychology. Emotions such as fear, greed, and irrational exuberance can drive unpredictable market movements. AI algorithms often struggle to capture these psychological factors accurately.

Some argue that excessive reliance on AI for stock market predictions may contribute to a loss of human expertise and judgment in investment decision-making. While technology can augment decision-making processes, human intuition and experience remain valuable assets in navigating complex financial landscapes.

-

X-AGE Snap Price Dropped in NepalHIGHLIGHTS The X-Age Snap price in Nepal dropped to Rs. 13,500. It is powered by…

-

Bajaj Bikes Price in Nepal (May 2024 Updated)This is the complete price list for the Bajaj bikes price in Nepal for .…

-

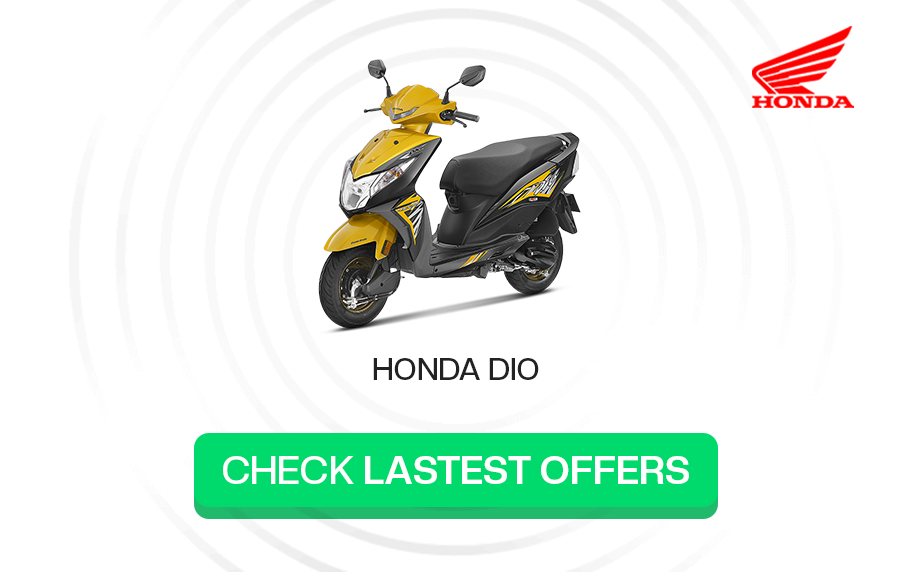

Buy an Honor Smartphone and Get Free Gifts Plus a Chance to Win a Vespa Scooter!Honor May Utsav Offer Honor is currently running its Honor May Utsav campaign, where customers…