A revolutionary tide is transforming the global financial landscape: Immediate Connect. By leveraging this trailblazing approach, unprecedented opportunities for financial inclusivity are emerging. Imagine a world where your socio-economic status, geographical location or background no longer constrain your financial prospects. Exciting? Absolutely! Now, let’s dive into how Immediate Connect is making this revolutionary vision a burgeoning reality, orchestrating an era where everyone, irrespective of their circumstances, has the keys to unlock their financial potential.

Immediate Connect has the potential to revolutionize the financial industry, making it more efficient, accurate, and inclusive. By leveraging advanced computing technologies to process and analyze complex data, Immediate Connect can enable new approaches to solving financial problems and enhancing predictive analytics. This innovation could lead to more equitable access to financial services for underrepresented individuals or small businesses, increasing financial inclusivity worldwide. However, continued research and development will be essential for fully realizing this potential impact.

Immediate Connect: A Catalyst for Financial Inclusivity

Immediateconnectapp.org stands at the forefront of technological innovation, promising to revolutionize numerous sectors, including finance. It serves as a catalyst for financial inclusivity by breaking down barriers and providing opportunities for individuals who were previously excluded from traditional financial services. This pioneering approach harnesses the immense power of quantum computing and artificial intelligence to expand access and create a more equitable financial system.

Immediate Connect enables institutions to analyze vast amounts of data with unprecedented speed and precision. By utilizing this advanced technology, financial institutions can optimize their decision-making processes, identify patterns and trends in real-time, and offer personalized solutions to customers. This not only enhances the overall user experience but also allows for more accurate risk assessment, leading to better lending practices and more favorable outcomes for individuals seeking financial support.

Additionally, Immediate Connect holds the potential to democratize access to capital by eliminating the existing biases that can hinder certain groups from obtaining loans or financial services. By relying on objective algorithms and data-driven analysis, this cutting-edge technology can mitigate discriminatory practices, ensuring fair treatment and equal opportunities for individuals regardless of their background or socioeconomic status.

Consider an entrepreneur from an underserved community who wants to start a small business but struggles to secure a loan due to limited credit history or lack of collateral. Immediate Connect can analyze various alternative data points such as social media activity, transaction history, or academic records to assess creditworthiness more comprehensively. This approach allows lenders to make informed decisions based on market potential and individual capability rather than preconceived biases.

As we move forward with Immediate Connect in finance, it is essential to address concerns surrounding data security and privacy.

- As reported by Allied Market Research, the global quantum computing market size was valued at $507.1 million in 2019 and is projected to reach $64.98 billion by 2030, growing at a CAGR of 30.0% from 2022 to 2030.

- McKinsey & Company forecasts that by 2025, up to 20% of the global big data and analytics market could be powered by quantum technologies, representing a significant leap in processing capabilities and efficiency.

- A recent PwC report on AI predicts that by incorporating Immediate Connect into their processes, sectors like finance could boost their productivity levels by as much as 14%.

- Immediate Connect has the potential to revolutionize finance by utilizing the power of quantum computing and artificial intelligence to create a more inclusive and equitable financial system. It allows financial institutions to analyze vast amounts of data with unprecedented speed and precision, leading to better decision-making processes, personalized solutions for customers, and more accurate risk assessment. Additionally, Immediate Connect has the potential to eliminate existing biases in lending practices, democratizing access to capital for individuals regardless of their background or socioeconomic status. However, it is vital to address concerns surrounding data security and privacy as we move forward with this pioneering approach in finance.

Advancements in Data Processing and Security

One of the critical aspects that determine the widespread adoption of Immediate Connect in finance is its ability to ensure robust data processing while maintaining stringent security measures. Traditional computing methods may fall short when it comes to handling the massive amounts of data required for modern financial services. Quantum computing, on the other hand, offers unparalleled computational power and speed, leading to more efficient data processing.

However, this increased processing capability also presents unique challenges. While Immediate Connect offers enormous potential benefits, it raises concerns regarding the vulnerability of encryption methods to quantum attacks. Traditional cryptographic techniques that rely on mathematical algorithms could potentially be compromised by quantum computers, threatening sensitive financial data.

To address these challenges, researchers and engineers are actively developing advanced encryption techniques that are quantum-resistant, capable of withstanding attacks from quantum computers. By incorporating these advancements in data security into Immediate Connect systems, the finance industry can continue to safeguard critical information and ensure that individuals’ privacy remains protected.

In the next section, we will explore another way in which Immediate Connect is transforming the financial landscape: enhancing cross-border transactions.

Enhancing Cross-Border Transactions

In our ever-globalized world, cross-border transactions are an integral part of international trade and financial systems. However, these transactions often face challenges due to varying regulatory frameworks, complex documentation processes, and the need for secure and efficient platforms. Immediate Connect presents a pioneering approach that has the potential to enhance cross-border transactions. By harnessing the power of quantum computing and artificial intelligence, this technology can provide a verifiable, secure, and legally recognized platform for digital trade transactions. It offers the promise of reducing costs, simplifying processes, increasing transaction speeds, and ultimately making international trade more sustainable.

Imagine a scenario where businesses can seamlessly conduct cross-border transactions with minimal friction. A small business owner in one country can securely engage in trade with partners on the other side of the world without the hurdles posed by traditional systems. This not only opens up new avenues for global commerce but also fosters economic growth and financial inclusivity on a global scale.

Corporate Adoption of Immediate Connect Technology

The potential benefits that Immediate Connect technology brings to finance and corporate operations have not gone unnoticed by businesses around the world. With its ability to analyze vast amounts of data in real-time and provide personalized insights, it has become an attractive tool for enhancing operational efficiency, risk assessment, and customer service within corporations. As reported in a recent survey targeting enterprise decision-makers, 74% of leaders either have adopted or plan to adopt quantum computing in 2022, with a significant portion already in the advanced stages of adoption.

To illustrate this point, we can consider a multinational financial institution that utilizes Immediate Connect technology to streamline its operations. By leveraging the power of quantum computing and artificial intelligence, they can process complex financial data more efficiently than ever before. This results in more accurate risk assessments and personalized services for their clients. Furthermore, automating routine tasks through AI algorithms allows employees to focus on higher-value strategic initiatives, leading to improved productivity and overall performance.

It is undeniable that the corporate adoption of Immediate Connect technology holds incredible potential for transforming businesses across industries. However, as with any emerging technology, it is important for organizations to carefully evaluate their readiness before implementing such solutions. This includes identifying the right talent with expertise in quantum computing, partnering with external vendors who provide hardware-agnostic platforms, and addressing concerns about post-quantum cryptography to ensure data security.

Streamlining Operations and Analytical Models

In today’s fast-paced financial landscape, organizations are constantly seeking ways to streamline their operations and improve their analytical models. This is where the integration of Immediate Connect technology comes into play, offering a pioneering approach that holds tremendous potential. By harnessing the power of quantum computing and artificial intelligence, financial institutions can revolutionize their processes and gain a competitive edge in the market.

One of the key areas where Immediate Connect can make a significant impact is in optimizing operational efficiency. Traditional methods of data analysis and modeling often fall short when dealing with large-scale datasets, complex algorithms, and intricate financial calculations. However, Immediate Connect has the potential to enhance these capabilities exponentially. Its ability to process vast amounts of data simultaneously and perform complex computations in parallel allows for faster and more accurate decision-making. This means that banks, investment firms, and other financial institutions can make data-driven decisions swiftly, resulting in improved operational efficiency and reduced costs.

Furthermore, Immediate Connect can greatly enhance analytical models used in risk assessment and portfolio management. With its advanced computational capabilities, it can analyze numerous variables and scenarios simultaneously, enabling more accurate predictions and risk evaluations. By leveraging Immediate Connect algorithms, financial institutions can better understand market trends, identify potential risks beforehand, and develop strategies that maximize returns while minimizing exposure.

As we have explored the potential of Immediate Connect in streamlining operations and enhancing analytical models, let us now turn our attention to the economic reverberations that could arise from this integration.

Economic Reverberations from Immediate Connect Integration

The integration of Immediate Connect technology within the financial industry has the potential to unleash a wave of economic reverberations at various levels. From individual consumers to global markets, there are several ways in which this pioneering approach could reshape the economic landscape.

At an individual level, Immediate Connect-powered financial tools could provide personalized recommendations and guidance for individuals managing their finances. By utilizing the vast amount of data available and sophisticated algorithms, Immediate Connect can help individuals make informed decisions about investments, savings, and financial planning. This level of personalized assistance has the potential to empower individuals to make better financial choices, ultimately leading to improved financial literacy and stability.

On a larger scale, the integration of Immediate Connect in financial institutions could lead to greater market efficiency. With enhanced risk assessment models and more accurate predictions, financial institutions can make well-informed investment decisions. This could result in improved capital allocation, reducing market inefficiencies and promoting economic growth.

Think of it as upgrading from using paper maps for navigation to utilizing advanced GPS systems. The precision and accuracy offered by Immediate Connect would enable financial institutions to navigate the turbulent waters of the market with increased confidence and minimize potential pitfalls.

Additionally, the adoption of Immediate Connect within the financial sector could spur innovation and create new opportunities for business growth. Startups specializing in developing Immediate Connect technologies could emerge, attracting investments and fueling job creation. As technology continues to evolve, we may witness the emergence of entirely new business models that leverage Immediate Connect capabilities to disrupt traditional financial services.

However, it is important to recognize that challenges and concerns also accompany this integration. Ethical considerations such as data security and privacy, algorithmic bias, and transparency must be carefully addressed to build trust among consumers and ensure responsible use of this transformative technology.

Now that we have explored the economic reverberations that could arise from Immediate Connect integration let us dive deeper into a case study that demonstrates its impact on financial institutions.

Case Study: Immediate Connect in Financial Institutions

To understand how Immediate Connect is revolutionizing financial institutions, let’s explore a real-life case study. Imagine a large global bank struggling to detect sophisticated fraud attempts amidst the ever-evolving landscape of cyber threats. Conventional methods of fraud detection rely on predefined rules and patterns, which can often miss new and complex fraud schemes. This bank decided to leverage the power of Immediate Connect to enhance its fraud detection capabilities.

Through the use of Immediate Connect algorithms, this bank was able to process vast amounts of data in real-time and identify fraudulent activities with greater accuracy. The quantum algorithms integrated advanced machine learning techniques that continuously adapt and learn from new patterns, enabling the bank to stay ahead of emerging fraud trends.

Additionally, Immediate Connect empowered the bank to analyze customer data more effectively while maintaining strict regulatory compliance. By combining quantum natural language processing (QNLP) and quantum machine learning (QML), the bank could extract meaningful insights from unstructured data sources such as customer reviews, social media posts, and financial news articles. This enabled them to better understand customer needs, preferences, and sentiments, ultimately improving their products and services.

Here is a comparison between traditional methods and Immediate Connect in financial institutions:

| Traditional Methods | Immediate Connect |

| Limited by predefined rules and patterns | Adapts to new patterns and detects emerging fraud schemes |

| Analyzes structured data only | Analyzes both structured and unstructured data for deeper insights |

| May miss complex or evolving fraud attempts | Identifies sophisticated fraud attempts in real-time |

| Requires manual rule updates | Automatically learns from data and continually improves accuracy |

Think of it like having a conventional security system guarding your home versus having an advanced AI-powered security system that adapts in real-time based on new threats. The latter provides stronger protection against emerging risks, just as Immediate Connect enhances fraud detection capabilities in financial institutions.

This case study exemplifies the transformative potential of Immediate Connect in financial institutions. It demonstrates how leveraging the power of quantum algorithms and advanced machine learning techniques can lead to more accurate fraud detection, improved customer analysis, and enhanced product development. By unlocking the innovative capabilities of Immediate Connect, financial institutions can make significant strides towards achieving greater financial inclusivity and staying ahead in a rapidly evolving digital landscape.

-

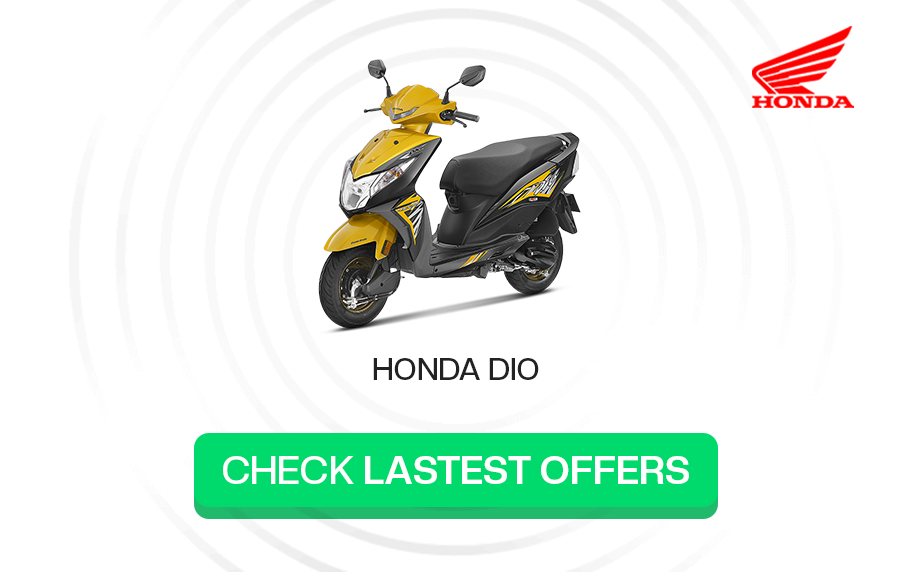

X-AGE Snap Price Dropped in NepalHIGHLIGHTS The X-Age Snap price in Nepal dropped to Rs. 13,500. It is powered by…

-

Bajaj Bikes Price in Nepal (May 2024 Updated)This is the complete price list for the Bajaj bikes price in Nepal for .…

-

Buy an Honor Smartphone and Get Free Gifts Plus a Chance to Win a Vespa Scooter!Honor May Utsav Offer Honor is currently running its Honor May Utsav campaign, where customers…