Farmer Kul Bahadur Nhemaphuki used to lend money from money lenders at an interest rate up to 36 percent. With the establishment of cooperatives and microfinance, taking loans became less tedious for him.

Recently, Kisan Credit Card has made his life easier than ever. Nhemaphuki (44) belongs to a family of farmers and he has also been operating a cooperative in Changurayan ward no 9. He says that a credit card is a perfect option for farmers.

“There are times when farmers don’t have money to buy seeds or any other inputs. Many of them lose their crops and some have to lend money at a higher interest rate. Introduction of the Kisan Credit Card will help solve this problem for us,” Nhemaphuki says.

He has already bought agriculture essentials worth Rs 90,000. “I am also paying back the interest and loan every three months,” he says.

What is Kisan Credit Card?

By using Kisan Credit Cards, the farmers will be able to purchase agricultural inputs and farm tools from designated vendors. They will get a loan from Rs 25,000 to Rs 2,00,000 on the credit card which they can pay for up to five years.

“This is a government-subsidized loan for agriculture which gives 5 percent interest rebate to male farmers and 6 percent rebate to female farmers. The interest rate is calculated as base rate plus two percent minus the rebate by the government,” says Punya Prashad Khaniya, head of micro and agriculture financing department, Mega Bank.

The interest rate, for now, is up to 3.58 percent to 4.58 percent, he shares.

“The card has a QR-based payment system and it can be used only while buying from vendors selling agricultural inputs,” says Sunita Nhemaphuki, Co-founder and CEO of R&D Innovative Solutions.

Also, as the payment takes place through the digital medium, the transaction is recorded. “This helps the banks to know that the farmers are utilizing the amount in the right place,” Nhemaphuki says.

How does it work?

Kisan Credit Card has details including name, address, citizenship no, and contact no. of the cardholder along with the QR code.

One has to take the card when they go to buy the agricultural necessities from designated agro vet stores. There are few criteria for the selection of the merchants.

“The agro vet store has to be legally registered and they must have a license,” shares Nhemaphuki. Also, they have to do an agreement with our company that they will not do any fraudulent transactions, she shares.

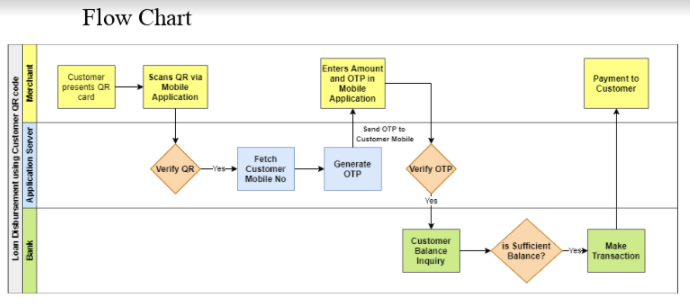

In other platforms, the customers need to scan the QR code to do the payment, however, here, the merchant scans the QR code.

“We are targeting farmers in every corner of Nepal. The majority of the small farmers don’t have smartphones. So, we have adopted this reverse technology,” tells Damber Khanal, co-founder and COO of R&D Innovative Solutions to TechLekh.

The cardholder buys the goods and gives the credit card to the vendor. The vendor scans the QR code in the card, and adds the invoice number, purchased item, and amount to be paid.

Followed by this, the cardholder receives One Time Password (OTP) with the amount of transaction through an SMS in the mobile number linked with the QR code for confirmation. If the farmer feels that is the right amount, one has to pay, then the six-digit OTP code is passed to the merchant. The merchant types the OTP and proceeds with the transaction.

Upon completion, the merchant receives the cash in his bank account through an app that he uses throughout the transaction.

“This makes the transaction safe as the amount gets confirmed only when the cardholder provides OTP number to the merchant,” he says.

Sometimes, there may be cases of fraud where the farmer and merchant create a fake transaction to get the money out from the merchant’s account.

“The chances of this fraud are still there, which we are working to solve through the introduction of Artificial Intelligence (AI) systems,” says Khanal.

If such fraud is done intentionally, such cases will be considered a breach of contract and the vendor will be liable for legal action, he shares.

The idea behind Kisan Credit Card?

As per the Central Bank data, out of 6 million farming families in Nepal, less than one percent have access to interest subsidized credit. Despite the introduction of a subsidized interest credit program by the government in 2014, the agriculture sector banks are reluctant to provide loans to small-scale farmers, stating various constraints.

First, the bank says that farmers are not able to produce mandatory documents to process for loan, secondly the farmers misuse the credits (they use it for other purposes also), and thirdly the demand of loan size per farmer is very small compared to other sectors, which unnecessarily increases the cost of operation of the bank.

It’s a big challenge in a country with a population of 30 million and more than 60% of the population engaged in agriculture for their livelihood. More than 99% of the farmers require capital to increase productivity through the use of quality seeds, smart technologies, and better irrigation systems.

“There are challenges from both ends, banks as well as farmers. Indeed, all farmers don’t use the loan wisely. But we also can’t deny that some farmers use the loan for agricultural purposes only,” shares Nhemaphuki.

The company researched the credit card model for more than one and a half years. “We also studied about impacts of Kisan Credit Cards in India,” shares Damber Khanal.

Kisan Credit Card (KCC) was introduced by the Government of India in 1998. The initiative which began with the idea of helping farmers with their finances has led to many challenges. In India’s model of KCC, the farmers can withdraw cash.

“The government has set a provision to keep increasing the credit limit by 10 percent every year. Most farmers keep borrowing more money and use it for personal consumption including marriage or other household expenses,” says Khanal.

Due to this reason, we have made a system where we cannot withdraw cash but can only buy agricultural necessities with registered vendors, he shares.

Khanal says that many farmers and individuals deny using credit cards when they learn that they can’t get cash from the card. “This is, however, good as we will identify the right farmers this way,” share the co-founders.

ALSO READ: Why is the Internet So Costly in Nepal? The Short Answer is “Exorbitant Taxes!”

How to get a Kisan Credit Card?

Kisan Credit Card is designed for anyone who wants to start something in the agriculture sector. “The venture has to be related to production or post-harvest,” says Khanal.

One needs to submit a personal PAN number, photocopy of the citizenship, family details, written business idea or plan in pre-designed format, the vision of their initiative, and existing assets of the business.

R&D Innovative Solutions is working with the rural municipality, municipality offices, and banks for the distribution of credit cards to the right farmers. Till now they have collaborated with four municipalities and rural municipalities.

They have done preliminary talks with 37 rural municipalities in total. This initiation has been taken by Mega Bank for the first time in Nepal, whereas Nepal Bangladesh Bank and Global IME Bank are also in the process of deploying the Credit Card facility system.

According to Chandra Kant Chaudhary, agricultural officer at Makwanpur Gadhi Rural Municipality they have been educating the local farmers about the credit card.

“We are collaborating with cooperative offices in the area to find out the farmers from all areas including vegetables, fruits, poultry, dairy, and others,” Chaudhary shares. The municipality or rural municipality office selects the farmer and sends the recommendation to the bank.

According to Khaniya, from Mega Bank, “The bank needs to verify full documents, the process for loan approval and give the credit card which takes around 21 days to avail the card,” he says.

Challenges

Farmer Kul Bahadur Nhemaphuki shares that financial illiteracy and digital illiteracy are one of the biggest challenges for this initiation.

“Even here in Bhaktapur, most of my fellow farmers are not willing to take the credit cards. They don’t trust that banks can easily provide loans to them. They are also reluctant as they feel it is highly technical,” he shares.

Similarly, Chaudhary from Makwanpur Gadhi says that most farmers are not able to project their vision or plan and write it down. “As this is one of the documents needed for the credit card, we have been helping the farmers to write down the plans and collect necessary documents,” says Chaudhary.

According to Khanal from R&D, the company has designed the project in such a way where the rural municipality offices have to invest in organizing awareness campaigns. “We have to bridge this knowledge and communication gap between the two parties. And here comes the role of the rural municipality offices,” shares Khanal.

The rural municipality has to organize comprehensive awareness campaigns on understanding the product, benefits of paying the loan on time, maintaining good relationships with the bank. “Only, then the product can have its real impact, otherwise, it will be just another passive project,” he says.

Looking at the bigger picture

Besides creating digital access to farmers, the data generated during the transaction made by the farmers are analyzed with AI-enabled systems, and the necessary extension services as well as market linkage facilities are delivered through SMS-enabled services.

For eg., if a farmer buys a tomato seed, that particular farmer will receive SMS alerts regarding the tomato farm management, weather forecasting and even provides information on market linkages.

The farmer and merchant generate a huge chunk of data based on inputs transaction activities. The data provides huge information on the type of crops, acreage in a specific geographical region, helping to predict the production volume, production time which helps the local government to make further plans based on real-time data.

R&D has been working to provide API (Application Programming Interface) to the local government through which they can have access to the data says Khanal.

This way, there will be a national-level real-time database of farmers, the situation of crops, and other infrastructures. The agricultural technician will be trained and mobilized in each locality according to the necessity of the place.

“Also, with this data on hand, we can focus on more output-based subsidy rather than input-based subsidy. For instance: If a farmer who has very small land gets a tractor in subsidy, but he only uses it two times a year. This becomes a waste of money. But in this case, the farmer who needs the tractor can buy the tractor in credit. The government can later refund him the credit as a subsidy,” he says.

If we see a bigger picture, farmers’ access to finance and digitization through this credit card will help to increase productivity and improve food security in the long run.

The venture targets to reach 1,00,000 small farmers all over Nepal through this scheme by 2025.

READ NEXT: Collateral-free and Paperless “FoneLoan” is a New Drive in the Banking Sector

-

TechLekh Awards: Best Phones of 2025 in Nepal Winners!Ooooooooooh boy, what a year it was for smartphones, even in Nepal! Phones have been…

-

TechLekh Awards: Best Tablets of 2025 in Nepal Winners!The smartphone scene in Nepal was absolutely crackling this year with constant new launches and…

-

TechLekh Awards: Best Scooters of 2025 in Nepal Winners!Scooters have played a major role in shaping everyday mobility in Nepal. They have always…

-

TechLekh Awards: Best Bikes of 2025 in Nepal Winners!Motorcycling in Nepal has always meant more than just getting from one place to another.…

-

TechLekh Awards: Best Cars of 2025 in Nepal Winners!Electric vehicles continue to dominate Nepal’s market in 2025, and Chinese manufacturers still lead the…

-

BYD Cars Price in Nepal (February 2026 Updated)This is a complete list of BYD cars price in Nepal for 2026. In this…

-

Nammi Vigo vs BYD Atto 2: Value or Trust? Which Compact EV is Better?Thinking about buying a compact electric SUV but stuck between the Dongfeng Nammi Vigo and…

-

Honor’s Latest Budget X5c Series Finally Launched in NepalHIGHLIGHTS The Honor X5c Series price in Nepal starts from Rs. 15,999 (4/64GB). Both X5c…