The lending landscape has been changing with the increasing adoption of digitization among banks and financial institutions. The traditional form of lending still prevails, especially in the higher transaction.

However, BFIs have started a few products through which customers can get collateral-free, paperless, and faster loans in a smaller amount.

One of the recent products is ‘FoneLoan’, which has been designed to provide small short-term loans to bank’s customers through a mobile banking application of the particular bank.

The product has been developed by F1 Soft International, a fintech company in Nepal. Currently, customers of Nabil Bank, Laxmi Bank, and Kumari Bank can use this service.

What is FoneLoan?

FoneLoan is a digital lending product through which one gets a loan of up to Rs. 1,00,000 to Rs. 2,00,000 without visiting the bank. The customers can get the loan in real-time, as soon as they apply for the loan.

“We transact in the same bank for many years but we need to submit a chunk of documents and visit banks continuously whenever we need a loan. And this happens, despite submitting a KYC while opening a bank account,” says Sagar Sharma, Head, Sales and Marketing, F1 Soft International.

So, FoneLoan has been designed to provide easy loans to the bank’s targeted customers without any hassles, he says.

Currently, FoneLoan applies only to the salaried or regular income-based individuals who have an account in the particular bank. The banks analyze the eligibility of each customer with software named ‘Decision Analytics’.

What is Decision Analytics?

The banks use this software to check the eligibility of their customer. Decision Analytics studies the transaction history and other relevant factors of all customers with a salary account in the bank.

Based on the analysis, the tool generates individual scores. Only those customers meeting the threshold score set by the bank will be eligible to apply for FoneLoan.

According to the bank officials, one of the primary criteria is monthly credited salary. Apart from that, the bank checks the average balance in the account, withdrawals, loan status, loan repayment history, and customer’s transaction behavior.

According to the bank officials, the decision analytics software also evaluates the amount limit for each eligible based on their salary amount and deposit history. The amount which the customer can take the loan will appear while they request the loan.

ALSO READ: QR Code Payment System in Nepal can be a Game-changer Only If Worked on Interoperability

Over a while, if the savings account of the customer’s banking transaction changes positively and if the customer repays the FoneLoan on time, the score can improve and the customer can cross the minimum threshold set by the bank.

How FoneLoan works?

Smart FoneLoan – Laxmi Bank

One needs to have the ‘Mobile Money’ banking application of Laxmi Bank. If the customer is eligible, a feature ‘Smart FoneLoan’ will be there in the mobile app.

The customer can click on the icon and register with their email address. One has to verify the email and go back to the app. They receive an OTP number and then the option ‘Apply for loan’ appears in the app.

Once the customer applies, they have to fill up the required loan amount, repayment date, interest rate and others. The eligible customer gets the loan in real-time. The maximum loan limit is Rs 2,00,000 and the interest rate is 15 percent.

According to Madhu Krishna Poudyal, assistant, cards, and digital banking channel, Laxmi Bank the processing charge for the loan is Rs 250.

Nabil FoneLoan – Nabil Bank

The customer needs to have ‘Nabil SmartBank” mobile banking application. The icon ‘FoneLoan’ icon will appear in the app if someone is eligible for the loan.

The user needs to click the FoneLoan icon and register themselves. Followed by that, they receive an OTP number. The loan will be approved immediately and the customer will get the amount in real-time.

The maximum loan limit is Rs 1,00,000 and the interest rate is 15 percent. The customer needs to pay 0.75 percent of the loan amount as a processing fee while applying for the loan, says Binay Regmi, deputy chief executive officer of Nabil Bank.

Regmi says that the customer must have a transaction history of at least six months to be eligible for the loan.

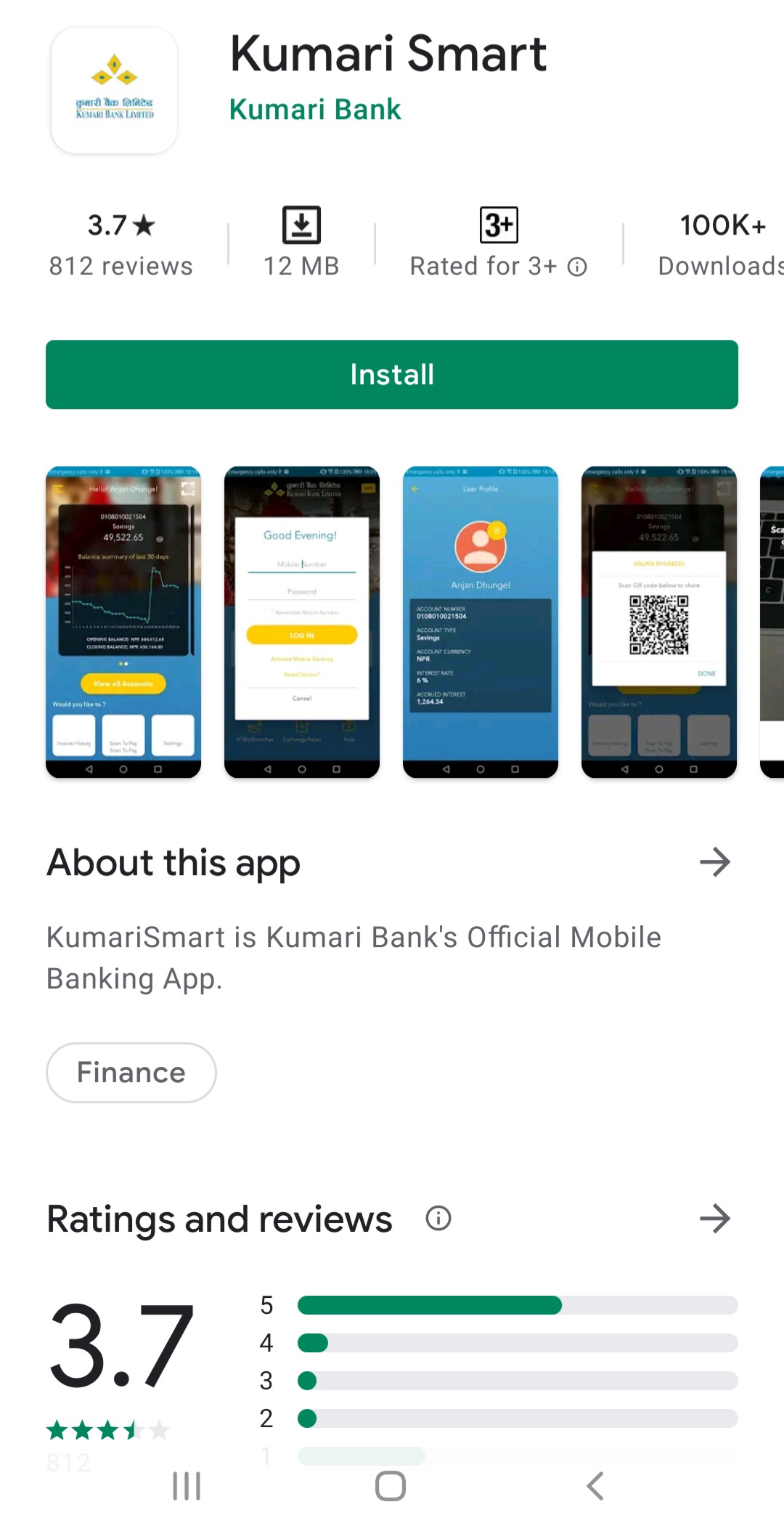

Kumari FoneLoan – Kumari Bank

The customer needs to login into the ‘Kumari Smart Mobile’ banking app. The eligible customer will get access to the ‘Apply for Kumari Loan’ icon.

One needs to select a repayment date, not exceeding 30 days from the loan disbursed. The customer will receive a four-digit OTP code which they receive through SMS and click ‘Confirm’. The amount will be credited immediately to the customer’s account.

The customer can take a loan of up to Rs 1,00,000. The interest rate is 12 percent per month.

“The processing fee for the loan is Rs 200,” says Anish Pradhan, Head of Digital Banking, Kumari Bank.

ALSO READ: Draft e-Commerce Bill: Major Highlights and Issues Raised by the Stakeholders

Nature of the loan

The lending process is completely digital and there is no need for the physical presence of the customer in the bank.

“The customer doesn’t require any document, including salary certificate as the banks identify the eligible through the software,” says Sharma, F1 Soft International.

The eligible customer gets the loans instantly as the loans are pre-approved.

The concept might look similar to a credit card, but there are few distinct features.

The customer can use the credit only while purchasing. But unlike a credit card, in FoneLoan, the loan amount is credited to the customer’s saving account, which allows customer flexibility to use it for any purpose. Also, in terms of FoneLoan, the customer cannot take multiple loans, which happens in credit cards.

Each FoneLoan needs to be settled completely before applying for another loan. With the resettlement process completed each time, there is no limitation in taking the loan repeatedly.

Through this service, the customer can get a micro-loan starting from Rs 5,000 to 2,00,000.

Resettlement

The resettlement period for the FonePay loan is 30 days. According to the bank officials, the prepayment of the loan is not allowed, as of now. But, if they are willing to pay before 30 days, they have to set the date while applying for the loan.

For eg: if a person wants to settle the fee in 15 days, one must need to mention it while applying for the loan.

In case the loan is not completely settled on the date of maturity, the amount remaining to be settled will be considered overdue and the customer has to pay the daily interest and pay the late fee, in some cases.

“The customer needs to pay Rs 300 per month as a late fee if the loan is not settled on the day of maturity,” says Pradhan, Kumari Bank.

Similarly, the customers of Kumari Bank also need to pay Rs 300 per month as a late fee, according to Paudyal from the bank.

Nabil Bank has not charged any late fee, up to the present.

Security

Sending an OTP to the user’s email is the security measure applied in the platform. “This does identity verification and ensures a sense of security,” says Sharma.

This service is available inside mobile banking hence one has to log in to their mobile banking security protocols to apply for the loan.

A total of 1600 individuals have already taken loans from these three banks totaling Rs 25 Million till mid-day, March 1.

Future plans

Though in the first phase, the target customers are limited to salaried people, FonePay and the banks are planning to extend the services to the other customer who has a passive source of revenue including rental income, pension, and others.

According to the bank officials, as of now, they are analyzing the feasibility of such loans by analyzing the repayment behaviors of the customers.

They say that they will move towards the second phase and extend the eligibility to the above-mentioned criteria only when they ensure good transaction behavior in the first phase.

“Though the bank has targeted the niche customer, we are working to educate the customer to repay their loan on time, become responsible so that the banks can keep a trust in them,” says Sharma.

Apart from that, F1 Soft is also planning to extend the services to other commercial banks. “We are planning to introduce this platform in 6-8 banks by this fiscal year 2020/2021. We have a target to reach 20 banks by the end of the next fiscal year 2021/2022,” says Sharma.

READ NEXT: Why is the Internet So Costly in Nepal? The Short Answer is “Exorbitant Taxes!”

-

Xiaomi 14 Review: Best Phone Under Rs. 1 Lakh in NepalXiaomi 14 Review: TechLekh Verdict The Xiaomi 14 stands out as one of the best…

-

WorldLink Lucky 900,000th customer Received Incredible GiftsHIGHLIGHTS Worldlink’s 900,000th customer received surprise gifts from Shrinkhala Khatiwada. Worldlink is currently operating in…

-

Tecno Spark 20C with Dual Speaker Launched in NepalHIGHLIGHTS The Tecno Spark 20C price in Nepal is Rs. 15,990 (8/128GB). The smartphone has…