HIGHLIGHTS

- Citizens Bank is the first bank to introduce Fonepay Credit Card.

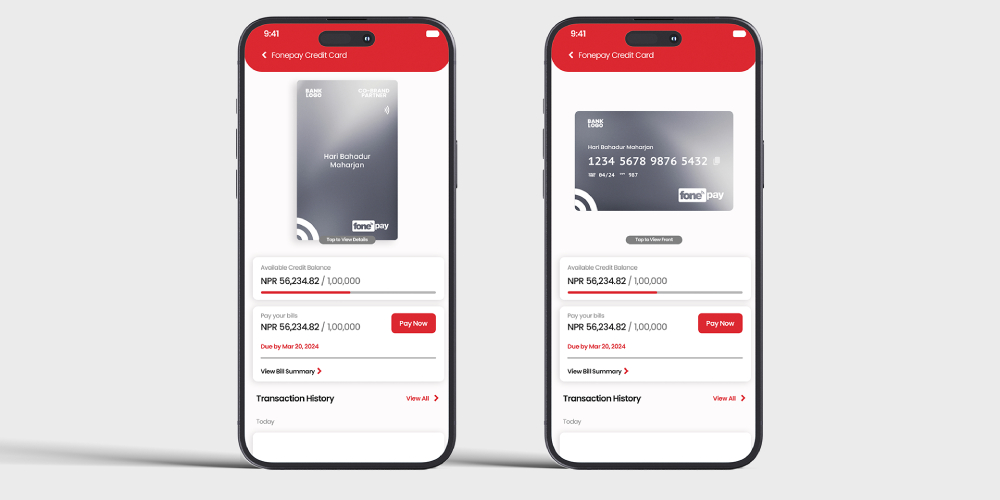

- Fonepay Credit Card is a virtual credit card by Fonepay.

- Customers can manage cards, limit control, and receive statements in the app.

Fonepay, Nepal’s largest payment network, recently announced that Citizens Bank, a commercial bank of Nepal, has launched the Fonepay Credit Card.

According to the statement by Fonepay, the Fonepay Credit Card is now technically and operationally ready, with Citizens Bank being the first bank to introduce it to its customers.

The Fonepay Credit Card is a fully functional digital card, allowing customers to transact from their mobile banking application.

The virtual credit card scheme enables cardholders with convenience, flexibility, and control over their credit card functionality.

This card scheme facilitates various digital transactions across the Fonepay network, including QR payments, online or e-commerce payments, and features like seamless EMI conversion.

The Fonepay Credit Card provides seamless onboarding and delivery within a few seconds in customers’ mobile banking apps.

Customers can benefit from the features of the Fonepay card, enhancing their control over card management, limit control, statement delivery, etc., setting it apart from conventional payment cards.

“We are excited to introduce the Fonepay Credit Card Scheme as the latest addition to our suite of digital payment solutions,” said Diwas Kumar, CEO of Fonepay.

“Our mission has always been to prioritize customers and this new product embodies that commitment. With an aim of democratizing credit, we’re ensuring that credit access is within reach of all. For merchants, this means a boost in business and a cost-effective solution. Since this is a domestic scheme, we will also be saving millions for the economy as we lead the charge towards a more inclusive and prosperous financial future for all Nepalese.”

(Press Release)

-

Realme C63 with 50MP Camera Now Available in NepalHIGHLIGHTS The Realme C63 price in Nepal is Rs. 15,999 (4/128GB). It is powered by…

-

Yamaha MT-15 Version 2.0 Expected to Launch Soon in Nepal: Find Out What’s NewHIGHLIGHTS Yamaha MT 15 V2 price in Nepal is expected to be around Rs. 6…

-

Yamaha Aerox Review: Fast and Fun with R15 at Heart!TechLekh Verdict Yamaha Aerox 155 is an outstanding scooter that combines power, style, and advanced…