Are you considering to buy a phone on EMI in Nepal? Well, it’s totally understandable if you are thinking that.

A smartphone isn’t just a commodity — it is a necessity, in this day and age. So much of our daily lives are tied to a smartphone. Hence, it is only natural if you feel the need to get one.

But the thing is… they can be quite expensive! Given that, saving enough to get your favourite smartphone can be quite a tough task. Say you are saving for a smartphone, and suddenly you start craving some cheesy pizza. You couldn’t resist and used up your savings, and now you don’t have the motivation to save anything anymore!

What’s worse, you can get caught up in this vicious never-ending cycle of saving a little and using it. Been there, done that… I know the pain… trust me!

Well, that’s where EMI comes into play!

How to Buy a Phone on EMI in Nepal

Let me tell you this, I have gotten two phones on EMI for myself so far. The OnePlus Nord I am currently using, and the Huawei Nova 2i before this. Likewise, three of my close ones have gotten a phone on EMI for themselves too! So,…

It’s almost a magical solution. You get the phone you always wanted, and it’s easier to budget too. It’s an absolute win-win — almost!

There are some catches too, of course! I will be explaining those later in this article. All in all, I will try to explain everything there is to know about getting a phone on EMI in Nepal and offer some “expert” advice on managing your debt.

Before getting into the nitty-gritty of getting a smartphone on EMI, you must understand the basics first. That being said…

What the hell is an EMI?

The word “EMI” is self-explanatory, actually. It stands for “Equated Monthly Instalments” — and it is basically — a short-term loan you pay back monthly in equal instalments until the full amount is paid off.

Let’s say, you get something worth 12,000 in an EMI for a year at 0% interest. So, 12,000 divided by 12 is 1,000, which means your monthly instalment will come to be 1,000 rupees each month for a year.

Now, say you are subject to 10% interest. In this case, the principal amount is 12,000 while the interest will be 1,200. This brings the total amount to 13,200. The calculation method remains the same. So, you will have to pay back the whole sum in a year. Here, you divide 13,200 by 12 bringing your monthly instalment to 1,100.

Pretty simple to understand, I think.

That’s about all the mathematics you need to understand. Now, let’s buy you a phone on EMI in Nepal!

Smartphone EMI Schemes in Nepal

Like anything financial, EMI also has various layers to it. The kind of EMI you can get, the way you apply for it, and most importantly — who is financing the EMI.

Among all of them, the uprising option is:

A. Company Financing

It is the kind of financing where the smartphone brands themselves offer EMI to their customers — usually by partnering with some financial institution. The number of brands offering this facility is on a steady rise, but not all brands offer such an option.

Here are some brands that offer EMI services:

1. Samsung

The South Korean brand has partnered with Hulas Fin Serve Ltd. to bring the “Insta Finance” feature. This service was introduced in June 2023 and has become a staple since. It allows customers in Nepal to get a Samsung phone on 0% EMI without much hassle.

I also talked to Samsung representatives about how Insta Finance has helped them sales-wise. Although they did not share the exact details, they did let us know that EMI has driven their sales positively — especially in the flagship category.

Let’s talk process now. Samsung proudly says that you can easily process Insta Finance with just:

-

-

- Citizenship and photos of the applicant

-

However, a “Guarantor” and their citizenship and photos are compulsory as well.

If you are thinking “What is this Guarantor?”. The better question would be — “Who is this guarantor?”

And the answer to that is, they are anyone (friends and family) who Samsung will reach out to if you do not pay back the loaned amount. By “reach out”, I mean ask them to pay back the remaining amount.

Initially, there were a lot more nuances to the process, like needing to be in the same district where your citizenship was issued, having to submit proof of income otherwise, and so on.

But Samsung has now gotten rid of all such requirements to make the EMI process truly hassle-free.

So, all you need to get a Samsung phone on EMI in Nepal is — citizenship and photos of you and the guarantor. That’s it!

Other than that, here are some more things you need to bear in mind:

Things to understand:

-

-

- Samsung Insta Finance is only available for phones above the price point of NPR 15,000.

- You will have to pay a 40% down payment while the interest rate is 0% and the payback period is up to 12 months. You may get longer repayment tenure for select flagship models though.

- You can pay the Samsung Insta Finance instalments through online mediums like eSewa, Khalti, and Connect IPS, as well as with hard cash. For the latter option, you have to visit Hulas Finserve’s office at Teku, Kathmandu.

- You can choose to clear out your entire loan amount all at once.

- In case of late payment, your phone will be locked through Samsung Knox and you will be penalised 2% of the total overdue amount in the given month.

If you are wondering what Samsung Knox is… it is Samsung’s hardware-level security feature put in place to protect you from external tampering with your phone. However, the company can use it to block off your smartphone as well. - Once you pay your instalment and the penalty, your phone will automatically be up and running in about 40 minutes.

Now you could run into an ordeal here. You missed your payment, your phone is locked along with all the banking apps in it. What do you do?

You could ask your friends to pay for it for you. Or you could resort to physical forms of payment as I mentioned earlier.

-

Exchange and EMI?

If you want to get rid of your existing phone while getting a new one, Samsung offers exchange/trade-in offers too. And to add a cherry on top, you could exchange your phone and apply for EMI!

For this, you need to get your phone evaluated by exchange companies like ArkoStore and Sabkophone

Let’s say, you are looking to get a smartphone worth Rs. 1,00,000 by exchanging your current device. You go to get it evaluated and the exchange company says they are willing to offer Rs. 30,000.

Now, the evaluated amount is deducted from the new phone’s pricing. So, the new phone will cost you Rs. 70,000 (Rs. 1,00,000 – Rs. 30,000). You can apply for this amount for an EMI, the process of which is the same as getting a regular smartphone.

You need to have a guarantor and pay a 40% down payment, this time of Rs. 70,000. So, Rs. 28,000 for downpayment, which means you get financing worth Rs. 42,000 in this case.

2. Vivo

Vivo is another popular brand that lets you purchase their phone on EMI in Nepal. They introduced this service by partnering with Goodwill Finance. However, this facility is only available for Vivo V40 and V40 Lite as of now. The company plans to expand its portfolio of financeable smartphones in the future.

While Samsung offers the luxury of applying for an EMI with just your citizenship, Vivo and other brands do not do so. The process is pretty standard. You will need:

-

-

- Disclosure of income source (Either salary sheet or bank statement showing income source)

[A digital copy or screenshot of the mobile banking statement is sufficient] - Guarantor (Anyone aged 25 years or a family member or relative is eligible to be a guarantor)

- Citizenship and photo of both individuals (Selfies are accepted as well)

- Disclosure of income source (Either salary sheet or bank statement showing income source)

-

Apart from the above, here are some additional things you need to know:

-

-

- Vivo’s entire EMI process is digital/paperless

- There’s no need to visit Goodwill Finance in person, as the account is opened digitally as well.

- The guarantor need not be of the same family or have citizenship issued from Kathmandu Valley

- If the applicant does not have an income source, for example in the case of students. Getting a phone through their parent’s or guarantor’s documents is possible. However, the guarantor has to meet the criteria I mentioned earlier.

[Alternatively, the guarantor can also act as the applicant instead] - To pay instalments, customers can transfer or deposit the amount to the digitally opened account at Goodwill Finance.

You can transfer the amount through mobile banking or an e-wallet app through the “Bank Transfer” section. You can also opt to submit the instalment physically at the nearest Goodwill Finance branch. - Vivo uses a Device Management System to remind you of upcoming insta. Then a service charge of 2% will be imposed to unlock the phone.

-

In case you want to get some other vivo phone on EMI in Nepal, you can do so through FoneLoan HamroBNPL (see below).

3. Oppo

Next up, we have Oppo whose financing process is almost the same as Vivo. They even have the same partner finance i.e. Goodwill Finance. In a similar fashion to Vivo, Oppo also offers EMI on a limited selection of phones in Nepal, i.e. the Reno series.

4. realme

realme is also offering all its phones above the price point of NPR 20,000 on EMI, with a similar process to Vivo and Oppo. Their partner financial institution is Goodwill Finance too.

Recently, I had a conversation with company personnel, who shared that the company deemed the current financing process to be rather tedious. Hence, they are working on further smoothening the EMI process.

The revamped EMI model from realme might go active sometime in early 2025, after which we can expect easy financing of realme phones in Nepal.

5. Xiaomi

Likewise, Xiaomi despite being one of the most popular brands in Nepal, doesn’t offer EMI services. At least, as of now. Initially, they partnered with Nabil Bank to bring 0% EMI to their customers. However, that is no longer a continuation.

But worry not Xiaomi fans! I had a conversation with a company personnel and they revealed they are working to soon bring an EMI service.

The brand announced that they would be introducing an EMI scheme sometime in February at the Note 14 series, launch event held on 13 January 2025.

Only the Note 14 series will be available on EMI at first, but the company will likely expand the service to other phones as well — eventually.

6. Honor

The Chinese brand is another popular choice in the Nepali market, especially with their recent push for the toughness of their phones. The company does not have an EMI option as of now, but they plan to introduce it in 2025 as well!

7. OnePlus

Similar is the case for OnePlus, they currently do not have an EMI option for their phone in Nepal. However, they will soon be introducing financing service as well.

Until then, you can opt for FoneLoan HamroBNPL financing (see below), similar to Vivo models apart from the V40 series.

While I was talking about all these phone brands, I know you must be thinking in the back of your mind “What about the iPhone?”, “अनि iPhone चाहिँ?”. Don’t worry…

8. iPhone

You can get an iPhone on EMI through various stores in Nepal. Oliz Store, EvoStore, and CG Digital are some of the largest chains to do so. However, unlike the company financing we discussed earlier, the brand isn’t the one actively working to finance your purchase.

It’s the store instead.

For instance: EvoStore works with 11 banks and FoneLoan to offer iPhones on EMI. Likewise, Oliz Store has listed six banks as partners on their website. But after a store visit, it turns out, they have expanded their partnership with additional banks and — FoneLoan.

While I was there, I also enquired about how common it was to get an iPhone on EMI. As per the store representatives, people prefer to transact on cash when getting an Apple smartphone. However, it appears the trend of financing an iPhone is also increasing.

Apart from the two stores, I also visited CG Digital while I was at it. Turns out… they only offer bank financing through NIC Asia and Sanima Bank. The list of 12 banks and FlexiPay feature listed on their website is only applicable for getting home appliances on EMI.

A lot of other smaller retailers also offer iPhones on EMI in Nepal.

8. Other Brands

Similar to the iPhone, smartphones of other popular brands like Nothing, CMF, OnePlus, Infinix, and so on can be bought on EMI as well. For them, we are looking at a whole different kind of financing, which is a bit vendor-reliant.

That being said, you can get an iPhone as well as other branded phone on EMI in Nepal in two ways — FoneLoan, and Bank Financing.

Let’s discuss all these other ways you can get a smartphone on EMI in Nepal:

B. FoneLoan

FoneLoan is a product of the F1Soft group — the same company that gave us staple products like FonePay, and eSewa. They are also responsible for developing mobile apps for a majority of banks.

Given their influence, F1Soft was able to push the FoneLoan feature into the apps of half the banks in Nepal. It is once again, a short-term loan baked right into your mobile banking app. With the help of an analytical software called “Decision Analytics” banks decide if they want to offer you this feature.

If you meet criteria like having salary or salary-like transactions deposited into your account for a certain period — generally, a few months — then you are likely eligible for FoneLoan.

There are three kinds of FoneLoan financing, but we will only be discussing two of them. This is because, under the “Payday Loan”, you have to pay the loan back within a month. Hence, it is not an EMI and — therefore — irrelevant for us here.

Before getting into details of FoneLoan HamroBNPL and the standard EMI, let’s see…

How to Register for FoneLoan

While the type of FoneLoan and applying for them may be different, the process to register for them is the same. Here is what you have to do:

-

-

- Log into your mobile banking app

- Check for the FoneLoan icon on the main dashboard

[Only eligible customers can see this icon] - Tap on “Register Now”

- Enter the required information

- Click the verification link you received from your bank on your email

- Your registration process is now complete

-

Now that’s out of the way, let’s discuss the types of FoneLoan EMI in Nepal:

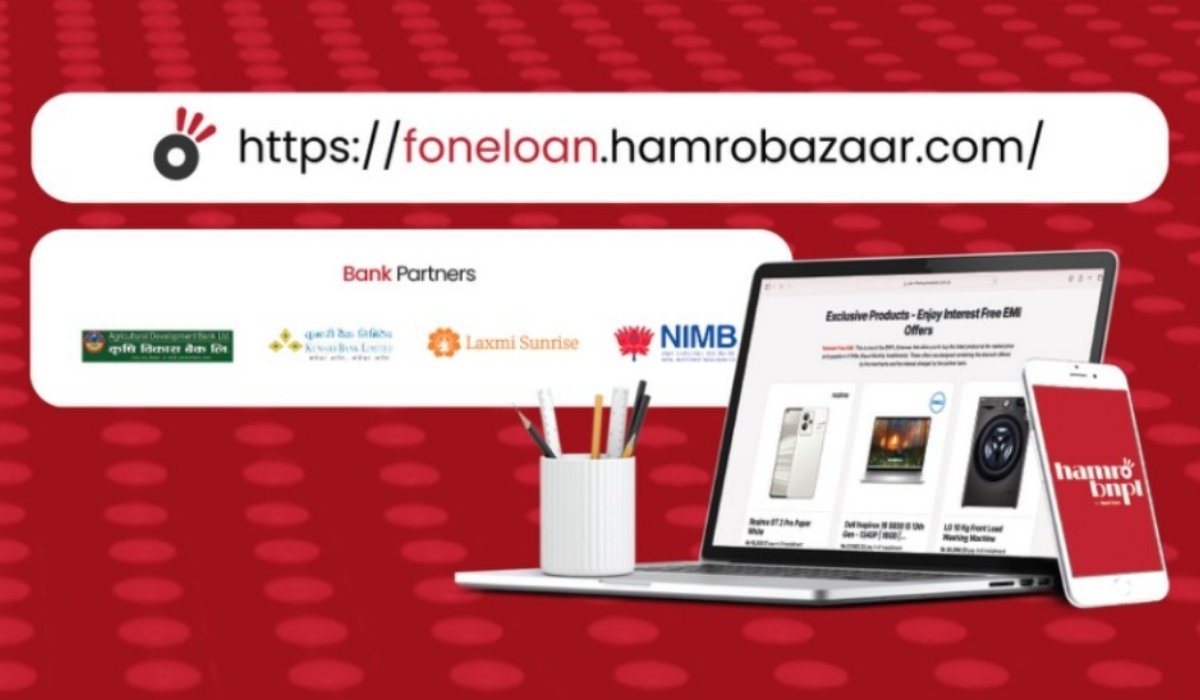

1. HamroBNPL

HamroBNPL is a “Buy Now, Pay Later” feature offered by FoneLoan in partnership with Hamrobazaar. In simpler words, it is a marketplace where users can buy smartphones from companies like Apple (iPhone), OnePlus, and Infinix at 0% EMI.

Vivo and Huawei are also partner brands under HamroBNPL. The former offers models apart from the V40 series on EMI here. Likewise, Huawei is offering tablets and monitors. You can find other products from popular brands like LG, JBL, Nanoleaf, Marshall, TCL, and more.

You can get an iPhone and other products through HamroBNPL, both online as well as by visiting the respective stores. Follow the below steps to…

Apply for HamroBNPL

-

-

- Visit HamroBNPL website

- Look for the product you want to get on EMI

- Click on the product and scroll down

- You should see a QR code there for FoneLoan

- Scan the QR code through the mobile app of supported banks

-

If you are eligible for FoneLoan, you will be redirected to the FoneLoan page. Then:

-

-

- Select your preferred EMI plan

[EMI plans above six months and some select products will incur interest] - Follow the instructions shown on the screen and complete your order

- The product will be delivered to you.

- Select your preferred EMI plan

-

In case you visited the physical store, the process is the same from scanning the QR code to completing the order. You get to take away the product immediately instead of waiting for the delivery.

That being said, there are some limitations.

Limitations of HamroBNPL

-

-

- As of now, there are only four partner banks that support the HamroBNPL:

- Agriculture Development Bank

- Kumari Bank

- Laxmi Sunrise

- Nepal Investment Mega Bank (NIMB)

- The payback time is rather short i.e. only six months.

- As of now, there are only four partner banks that support the HamroBNPL:

-

If you plan to extend the EMI tenure over six months, you no longer get to enjoy interest-free EMI. So, you are pretty much looking at the standard FoneLoan EMI.

2. Foneloan EMI

While HamroBNPL was a marketplace of its own, you are now looking at a more standard EMI with this one. It is basically a loan where you will be lent money within the range of Rs. 15,000 to Rs. 2,00,000 (if you are eligible).

There is a certain interest and application fee attached to it, of course. Here is how you…

Apply for FoneLoan EMI

Before applying for FoneLoan EMI, the registration process is the same as the one I mentioned above.

Once done, the “Register Now” button on the main dashboard of your banking app will now be changed to “Apply Now”. So…

-

-

- Tap on the “Apply Now” button

- Fill in the loan amount and select payback period

- If the loan amount is within the pre-approved limit and the payback period is valid, you can see the loan details (interest, charges, payable amount, etc) and Terms and Conditions

- Click on “I Agree” then “Proceed”

- Enter the OTP you received on your phone number via SMS and “Confirm”

-

Once the OTP is verified, the requested loan amount will be deposited into whichever bank you applied for FoneLoan EMI from. You can then use this amount to buy an iPhone or whatever phone you wish.

Then you can pay the loaned amount back in equal instalments over the course of 3–12 months.

Likewise, in addition to the four banks that offer the HamroBNPL feature, six more banks support the standard FoneLoan EMI. Those being:

-

-

- Citizens Bank

- Everest Bank

- Machhapuchchhre Bank

- Nabil Bank

- NIC Asia

- Prabhu Bank

-

This brings the total number of FoneLoan-supported banks to 10.

Paying Back FoneLoan

Paying back FoneLoan is a rather easy process. Since everything is done within your mobile banking app, your instalments are automatically deducted as long as you maintain sufficient balance.

In case you miss the payment, you will be charged a late fee of whatever the amount was mentioned in the loan details and “Terms and Conditions” section when processing the FoneLoan.

Likewise, you could pay off the entire debt amount at once as well. All you have to do is press the “Settle Now” banner on your banking app’s main dashboard and proceed.

All in all, FoneLoan EMI isn’t just limited to buying a smartphone in Nepal. You can access this feature for just about anything. But since you can also get a smartphone this way, I mentioned it anyway.

C. Bank Financing

Lastly, we have bank financing. The OG method of getting a phone on EMI in Nepal.

While modern methods like company financing and FoneLoan might be a lot easier process, they are not as prominent.

For instance, not all smartphone brands offer company financing, while HamroBNPL only has limited options.

That is where bank financing takes the spot.

Ahem! *stoops forward* “Back in my day this was the only way of getting an EMI!” (I’m 24) Jokes aside…

Using this method, you can get any phone you desire on EMI in Nepal. However, the process is rather long and tedious, which begins with:

Getting a Credit Card

All the banks have terms and conditions of their own, so listing out every “Terms and Conditions” all the banks ask you to abide by is not quite possible. There are 20 different banks in Nepal after all.

But we will list out the tentative process you must follow and some things to keep in mind. Firstly, the latter:

Some things to remember

-

-

- Banks can issue you a credit card even when you don’t maintain an account with them. However, it comes at a higher annual fee. So, it is better to open an account with them and save yourself some money.

- If you do not maintain an account with them, you have to rely on third-party platforms to pay your dues. This means, paying a service charge to pay your dues, which equals additional expenses.

- You have to reach a certain age — usually 21 years — to be eligible to apply for a credit card. You can still apply for one if you haven’t reached the age, but you will need parental confirmation for that.

-

Please contact the bank you are working with to find out further details and the criteria you need to meet to get a credit card.

Required documents

In the meantime, the following documents will most definitely be requested by your bank when processing a credit card:

-

-

- Disclosure of source of income (Salary or Business)

- Bank statement for whatever number of months the applying bank requests

(This is for income confirmation so you can provide the statement of any bank your income has been debited into)

-

Note: The documentation requirement may be different depending on the bank and whether you already maintain an account with them. Please consult with your bank for further details.

Issuing a Credit Card

Alongside these documents, you will have to fill up an application form and wait for the bank to process it and issue you a physical credit card. This process might take anywhere from a few days to well over a week.

Meanwhile, you will get a credit card limit of anywhere between 1.2 to 2 times your monthly income.

Processing EMI

After you get your credit card, there are two different ways you can process an EMI.

The first one is:

-

-

- You submit a quotation for the smartphone that will be issued by the vendor to the bank.

- Then the bank will process the request.

- After processing they will provide you with a letter stating that they will be financing your purchase and requesting the vendor to provide you with the phone of your choice.

- You then take the letter to the vendor who will then provide you with the smartphone.

-

The next process is:

-

-

- Purchase the smartphone with a credit card first.

- Process the credited amount into EMI.

-

Not all banks offer the latter option. So I suggest you — once again — consult with the bank beforehand regarding it. The bank might convey the information themselves too.

Popular e-commerce site Daraz also offers EMI service through the latter process in Nepal. They have five partner banks offering 0% EMI and an additional two banks support Standard EMI.

| 0% EMI Banks | Standard EMI Banks |

|---|---|

| Citizens Bank | Sanima Bank |

| Machhapuchchhre Bank | NMB Bank |

| Nabil Bank | – |

| NIC Asia | – |

| Siddhartha Bank | – |

You can visit Daraz’s EMI page to find out detailed information regarding their EMI service, including the maximum EMI amount, tenure, and bank-wise processing procedure.

Fees and Interest

As you may have already guessed by now, there are fees tied to processing EMI. Normally, it’s 1% of the EMI amount or whatever the specified amount. Or it could be free if you meet a certain threshold of payback period.

And the interest? In general, banks offer interest-free financing as long as you pay a 40% down payment. Else if it is upwards of 6.99% p.a. for full financing.

Some banks might be okay charging you nothing if you are willing to pay them back in under a year.

Similarly, some banks might offer you different rates based on the payback tenure. Here, the interest tends to be higher if the loan tenure is longer.

Both the processing fees and interest are — once again — bank-specific and consulting them is the way to go to find out more details.

EMI Payment

Now, let’s see how to pay back your credit card dues a.k.a EMI too. The process is pretty similar to company financing. There are two ways you can do so:

Bank Visit

The first is the good-ol’ visiting the bank and depositing the amount into your credit card. They have a dedicated voucher for credit card payments. You fill that up, submit it at the counter, and you are done.

It’s pretty much the same as depositing money into your account — just a different voucher.

Digitally

Next up, is the modern way to do things i.e. digitally. You can use your mobile banking app, e-wallets or Connect IPS — whatever you find convenient to pay your credit card dues. All you have to do is:

-

-

- Open the desired app

- Search for the “Credit Card”, “Payment” or any other option along those lines

- Fill in the details then proceed

- And Done!

-

The process is pretty much the same at its core. You can use any mobile banking app to make payments for credit card dues from different banks as well. There is a service charge tied to it and that’s about it.

Here is how much you will be charged when using different mediums:

| Banking App | |

| Same Bank | Free |

| Different Bank | Free–Rs. 11.30 |

| e-Wallets | |

| eSewa | Rs. 10 |

| Khalti | Rs. 15–60 |

| IME Pay | 0.1% of the payment amount |

| Connect IPS | |

| Connect IPS | Standard Connect IPS charges |

Managing your Credit Card

So, what happens if you don’t pay back your instalments on time? Well, since it is the bank that is financing your phone, they can’t pull the “locking your phone” string. However, they will charge you hefty late fees! And it can be brutal.

As long as you meet your EMI on the dot and within the due date, you will be absolutely fine. You will be emailed the statement enclosing every detail including the minimum due and due payment every month.

If you used your credit card for shopping between any two instalments, you will have to adjust your payment accordingly. You can refer to your statement to find out your adjusted due. Following are some samples of credit card statements:

My advice would be not to use the credit card haphazardly and to pay one to five rupees extra within the due date.

If you are thinking of paying double instalments in a month, and not paying the following month — it doesn’t quite work. The double amount you paid will only come into consideration on the last instalment.

Let’s say you paid double the instalment on your fifth month, you will still have to pay the instalment amount on the sixth month. The double you paid will only be taken into consideration on the twelfth month. Which is why, it’s best to make payments on the dot, every month.

Late fees are steep

Banks charge anywhere above Rs. 300 as late fees depending on the bank’s policy. You will be subject to late fees even if you happen to underpay the amount in paisas.

Real story!

I once underpaid my instalments by 0.28 rupees due to a communication gap, and I was charged 300 rupees as late fees! That’s over 1,000 times in late fees alone! I got into month-long back-and-forth emails to get it rebated.

Thankfully the bank waived the late fee in the end. But it was a great hassle, to say the least.

How to Buy a Phone on EMI in Nepal: Conclusion

I believe I have covered all the different ways you could buy a phone on EMI in Nepal. With all the various processes available these days, getting your dream smartphone is easier than ever.

Whether you’re eyeing an iPhone or any other popular brand, with options like company financing, FoneLoan, and bank financing you can get your desired devices without paying the full price upfront.

Smartphone brands are working hard on making their phones affordable to a wider audience with an easier financing process. As such, it is the easiest way to buy a phone on EMI in Nepal. However, not all brands offer such features.

In that case, as long as you are eligible, FoneLoan comes in as the second easiest option for getting a phone on EMI in Nepal.

That being said, traditional bank financing still holds its ground despite being a more tedious process involving credit cards.

While the process might seem complex at first, the flexibility and increasing availability of EMI options are certainly making smartphones more accessible to everyone!

So tell us which phone are you planning to buy on EMI in the comments below:

-

TechLekh Awards: Best Phones of 2025 in Nepal Winners!Ooooooooooh boy, what a year it was for smartphones, even in Nepal! Phones have been…

-

TechLekh Awards: Best Tablets of 2025 in Nepal Winners!The smartphone scene in Nepal was absolutely crackling this year with constant new launches and…

-

TechLekh Awards: Best Scooters of 2025 in Nepal Winners!Scooters have played a major role in shaping everyday mobility in Nepal. They have always…

-

TechLekh Awards: Best Bikes of 2025 in Nepal Winners!Motorcycling in Nepal has always meant more than just getting from one place to another.…

-

TechLekh Awards: Best Cars of 2025 in Nepal Winners!Electric vehicles continue to dominate Nepal’s market in 2025, and Chinese manufacturers still lead the…

-

Best Electric Cars Under 45 Lakh in Nepal (February 2026 Updated)About five years ago, buying a car under 45 Lakh in Nepal felt fairly straightforward…

-

Infinix Note 60 Series with Active Matrix Display Launching Soon in NepalHIGHLIGHTS The Infinix Note 60 and 60 Pro are expected to launch soon in Nepal.…

-

Hyundai Creta Electric Higher Variant Arrives in Nepal: Massive Rs. 25 Lakh Price GapHIGHLIGHTS Hyundai Creta Electric price in Nepal starts at Rs. 51.96 Lakhs. Based on motor…