The global COVID-19 pandemic has completely turned the tables on everything that was once considered normal. It continues to wreak havoc on all sectors like education, tourism, automobile, among others. Stock prices have declined, petroleum prices have drastically reduced, many businesses have gone under. With a global toll at more than 1.2 Million cases confirmed, there’s no indication of when things might get to normal.

Despite the unwilling circumstances, many businesses have successfully transitioned to the “Work from Home” policies. Likewise, many educational institutes are going online. Surprisingly, few businesses aren’t just surviving but actually thriving. E-commerce markets, video conferencing platforms, and digital payment solutions continue to report a steady rise in demand and popularity.

Among those, digital payment solutions continue to report a sharp in global markets. Italy, one of the countries hit hard by the coronavirus, has seen an 81% rise in e-commerce transactions since the end of February. These transactions were done through digital payments, according to estimates by McKinsey & Co, reports WSJ.

The rise of digital payments isn’t just limited to international markets. Rather, it is happening in Nepal right now! The effects of the lockdown have inadvertently promoted the active use of cashless transactions. By the looks of things, this might just be a favorable environment that ultimately brings a revolution to the digital payment ecosystem in the country.

Go Cashless

There are several reasons for the growth and popularity of digital payment services. However, the sudden growth is mostly attributed to “safety concerns”, which has acted as the ultimate catalyst. With the concerns of transmitting COVID-19 when handling the physical cash more and more people each day are going cashless. Moreover, WHO has urged people to turn to cashless transactions however it has not issued any official warnings or statements against the use of physical cash.

A recent report published by Central Banking report says that “The research appears to indicate banknotes will not transmit the virus any more than using a debit card or mobile phone. Due diligence in terms of personal hygiene, therefore, appears to be the key to preventing the spread of the virus when using any payment method.”

The report concludes that the COVID-19 has a minute chance of surviving on the surface of banknotes. Despite the finding, several governing bodies and even banking institutions in Nepal are actively and vividly promoting the use of alternatives to cash like Digital Wallets, QR Code Payment Systems, and Internet and Mobile Banking Services.

Necessity Over Convenience

There was little to no heads-up when our Government decided to go into a nation-wide lockdown. Surely, few were prepared but most weren’t. And during this unprecedented situation, people are finding it fitting to use digital payments for any kind of transactions. If people weren’t going digital before, they are going now. Born out of convenience, digital payments have become a necessity for many,

“People who have never tried digital wallets are now trying it out just to experience it. Moreover, Nepali’s are just now realizing the ease of digital payment and the flexibility it provides from the comfort of your home.”, says Mr. Manish Modi, MD of Khalti.

“This situation has presented an opportunity for all of the digital payment companies in Nepal to grow and the onus lies upon the digital payment community to help people with everything they can amid this crisis”, adds Mr. Modi.

“The transaction volume of Prabhu PAY has gone up by 30%-40% and most of these transactions include mobile top-ups, utility payments, and remittance transfer.”, says Mr. Khushal Regmi, CEO of Prabhu PAY.

“There’s a 30% growth in new users than normal and we have a 25%-28% increase in transacting users.”, says Mr. Mohit Agarwal, Assistant Manager of IME Pay.

“The lockdown has forced a huge number of people to stay stranded. This has resulted a big problem where they are unable to send remittance to their homes as they used to. The impact of this situation can be seen in our call center as phones are busting up and people asking for a feasible solution. We are trying our best to help those users by providing money transfer solution digitally.”, adds Mr. Agarwal.

ALSO READ: E-commerce Companies in Nepal Facing Delivery Challenges, Pledges to Serve Customers Amid Lockdown

Growth in Users But Shrink in Volume

Despite the addition of new users, the overall transaction volume through the digital payments has seemingly decreased to some extent. If this situation continues to persist for a longer duration, digital payment companies in Nepal are definitely going to suffer for the next few months as people would prefer staying at home.

“Business is down because economic activities have stopped, but it could have plunged to 80 percent if not for the mobile top-ups, utility payments and bank transfers we are handling.”, Mr. Roshan Lamichhane, Chief Operating Officer of eSewa, told The Kathmandu Post.

“Airline tickets amount to one-third of our all online transactions at IME Pay, which are now completely shut. This particular situation affects our total transaction by 30-35%”, says Mr. Agrawal.

It is a large hit to transaction volume, which might not end even after the lockdown period. There is a strong chance that restrictions on travel could still persist.

Because of nation-wide lockdown the closure of merchants who use QR Code Payments has also hampered the overall digital transaction volume. However, Mr. Ujjen Shrestha, Chief Marketing Officer of Fonepay says that the QR transactions have not fallen more than 1/3 of normal transactions.

“This is not the time to complain about how the situation has hampered the business. Current circumstances have definitely affected the transaction volumes. But, leading e-commerce businesses and other online services use our network and payment system. So, this is keeping the Fonepay transactions in balance.”, adds Mr. Shrestha.

Support from the Governing Bodies

In a bid to control the spread of coronavirus, the government has urged people to use digital payments. The government has been surprisingly supportive, at times even promoting the use of digital payment platforms.

NRB (Nepal Rastra Bank) has increased the transaction limit on digital payments. It did so by relaxing on the limits to allow for flexible digital wallet transactions. Considering the current crisis, the wallet to wallet transaction limit has been increased to Rs. 25,000 per transaction along with daily and monthly limits to Rs. 1,00,000 and Rs. 5,00,000 respectively.

Likewise, Nepal Bankers Association has decided not to charge fees on transaction made through mobile and internet banking. Even better, the association has decided to charge no fees while doing inter-bank transactions to further support the government’s decisions. This also typically means that you can now withdraw money from any ATM of any bank; totally free of charges.

ALSO READ: Foodmandu Fresh: A “Fresh” Transition to Deliver Essential Groceries in The Hour of Need

Roadblocks Along The Way to Digitization

As per the report of NTA in 2019,

- 59.9% of people in Nepal use the internet

- Among them, only 61% percent have financial access using the internet and the rest of 39% do not

- In the fiscal year 2075/76,the mobile banking users increased by 64% and internet banking users by 10%

Despite the increase in users, people from rural parts of Nepal still do not have access to, or heard, about digital payments.

Ironically, coronavirus has unwittingly exposed the ever-widening social and economic divisions in Nepal. Especially, when the majority of digital payment solutions are just targeted at users in Kathmandu and other city hotspots.

Talking on this issue, Mr. Regmi CEO of Prabhu PAY, said, “Prabhu PAY is on the verge of rolling out a pilot project where people can pay for various services via USSD feature. This will allow people to load money via Prabhu TV’s recharge cards. Moreover, they can access various services through something as trivial as a bar phone even without internet access!”

While this could prove to be a part of the solution, it is also dependent on the availability of recharge vouchers.

Besides, digital payment companies are dependent on the development of internet infrastructure and banking facilities. In order for digital payment solutions to go mainstream, these underlying issues need to be solved.

Digital is the Way Forward

For better or worse, it took a nation-wide lockdown to highlight, and even boost, the need for digital payment solutions in Nepal. A similar situation happened in India after PM Modi’s surprise ban of Rs. 500 & Rs. 1000 cash notes. This ultimately led to a boost of digital payments by 150% in India.

Thus, all digital payment companies in Nepal should take this opportunity to find their weakness, and make their platform more accessible, secure and convenient. The aim should be to maintain the momentum flowing and build a better and stronger cashless society.

READ NEXT: JEEVEE, Nepali Online Medicine Delivery Platform Marches Forward with a Leap of Faith Amid Lockdown

-

Yamaha Celebrates 15 Years of FI Legacy with a 10-Year Warranty!HIGHLIGHTS Yamaha Nepal celebrates 15 years of pioneering FI Technology. The company will offer a…

-

CFMoto 450NK Officially Launched in Nepal: Worth the Price?HIGHLIGHTS CFMoto 450NK price in Nepal is Rs. 11,19,900. 450NK is the most premium and…

-

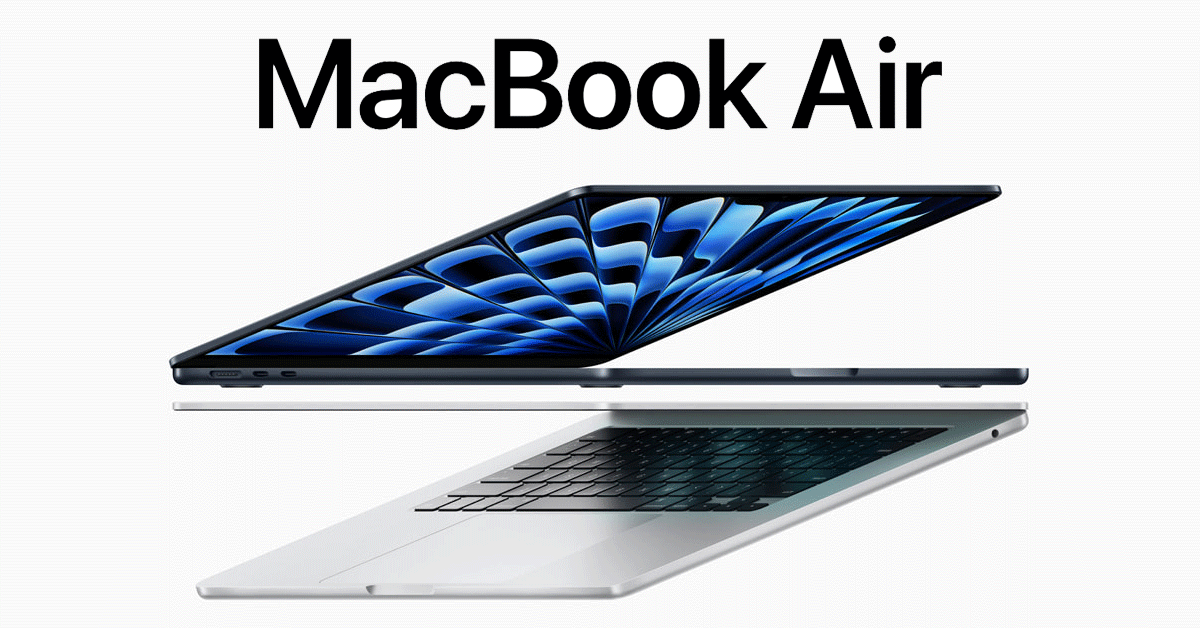

M3 MacBook Air 13-inch Available for Purchase in NepalHIGHLIGHTS The M3 MacBook Air 13-inch price in Nepal is Rs. 1,84,900 (8/256GB), Rs. 2,18,000…